MARKET FACTS

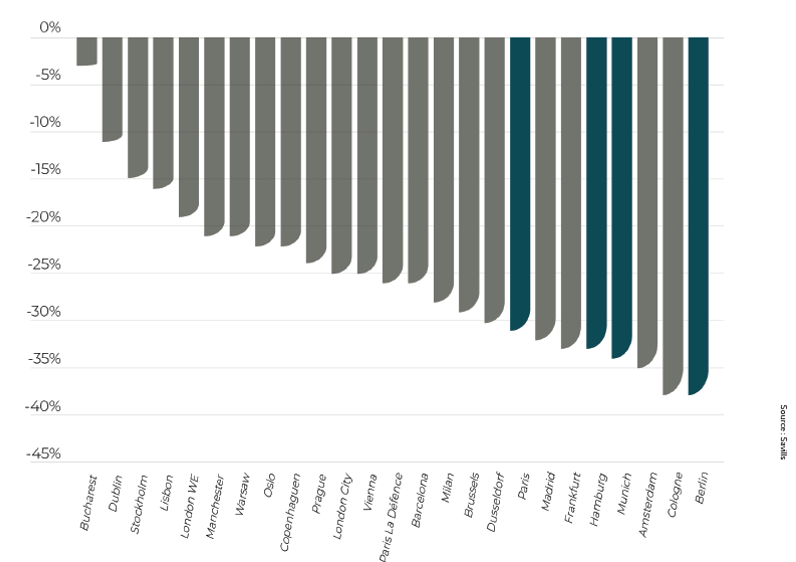

YIELD IMPACT ON CAPITAL VALUES SINCE Q1 2022

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

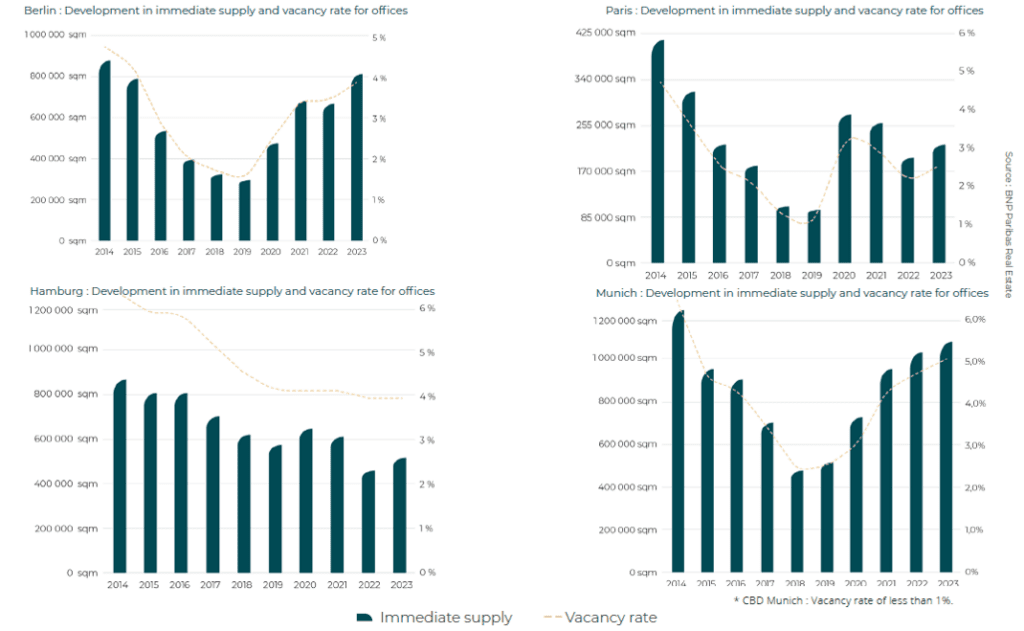

SOLID REAL ESTATE MARKETS

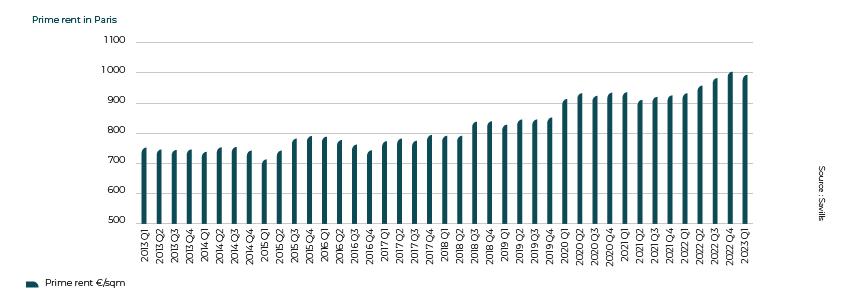

The markets in the four urban cities are relatively large and, above all, «solid», with an ongoing dynamic, as these graphs demonstrate. In fact, in Paris, the current vacancy rate is historically low and is essentially due to the residual balance, either to obsolete products or to the natural turnover of companies (growth, movement…).

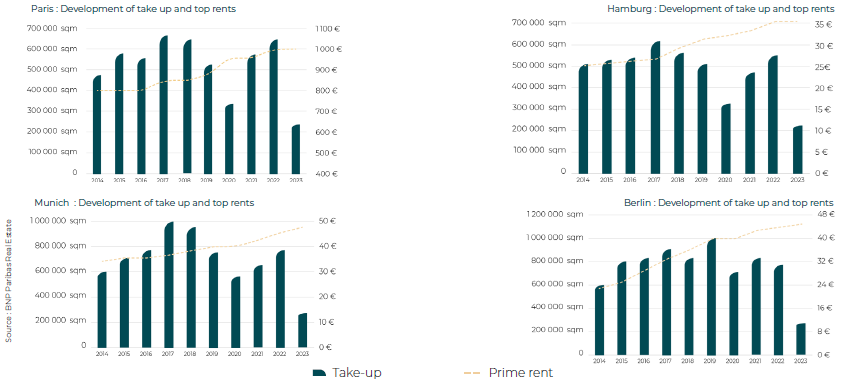

FOR A CONSISTENTLY CONFIDENT DEMAND

Over the past 10 years, rents in these major cities have been rising steadily, testifying to the continuing attractiveness of these markets to users. Moreover, the re-centralization of searches in the CBD is becoming increasingly apparent and has been accelerated by COVID.

Indeed, in their searches, users are focusing on central, accessible locations offering a high level of local services, to attract and retain employees.

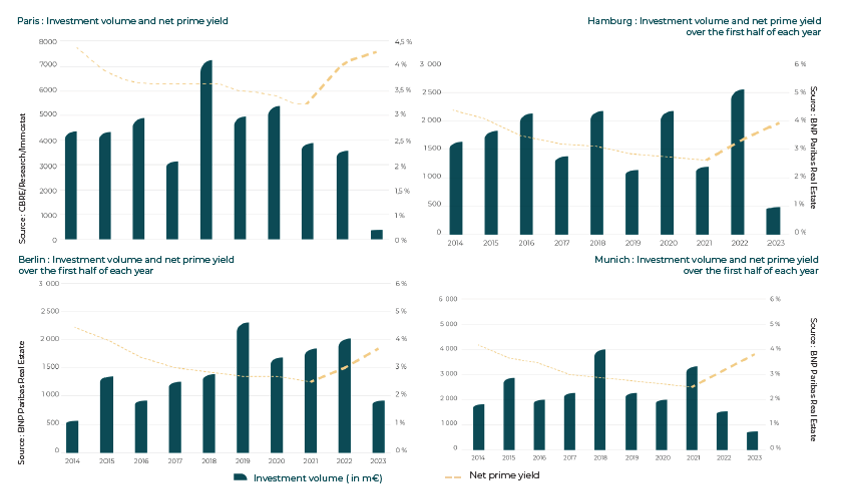

A RETREATING INVESTMENT MARKET

Since 2014, the rate of return on «prime» assets in the real estate market has been stable, while investment volume has oscillated. This stability indicates consistent compensation for the risks associated with real estate investments. Investors are attracted by this stable rate of return thanks to a steady demand for real estate in these major urban cities.

This drop in investment volume is mainly due to the significant rise in interest rates and bank lending conditions in terms of LTV, which put the brakes on all property companies, and to the significant increase in returns on the bond markets, which led insurers to prefer to rebalance their asset allocations by reinvesting massively in the less volatile, more liquid bond market for the same return performance, but without taking the cycling effect into account.

A MARKET OPPORTUNITY

Property prices have plunged sharply on prime assets, but yields are rising sharply, and the fact that vacancy rates are relatively low and there is constant rental demand with a stable supply gives a scarcity premium which shows that the risk/return ratio is tending to become increasingly favorable for this investment niche.